Wildlife elimination has become a growing industry. Knowing how to get rid of attic raccoons, how to get rid of nesting squirrels and chew your house, or even how to get rid of an armadillo by digging up your lawn has become more difficult for property owners and managers to handle.

The problem has become too big for cities to handle, so a new industry has been born, Nuisance Wildlife Removal. The most annoying wildlife are raccoons, squirrels, rats, bats, possums, skunks, snakes, and armadillos. Wild pigs have recently become a common nuisance. Pigs have mostly affected the agricultural industry and livestock, but it is also becoming an urban nuisance.

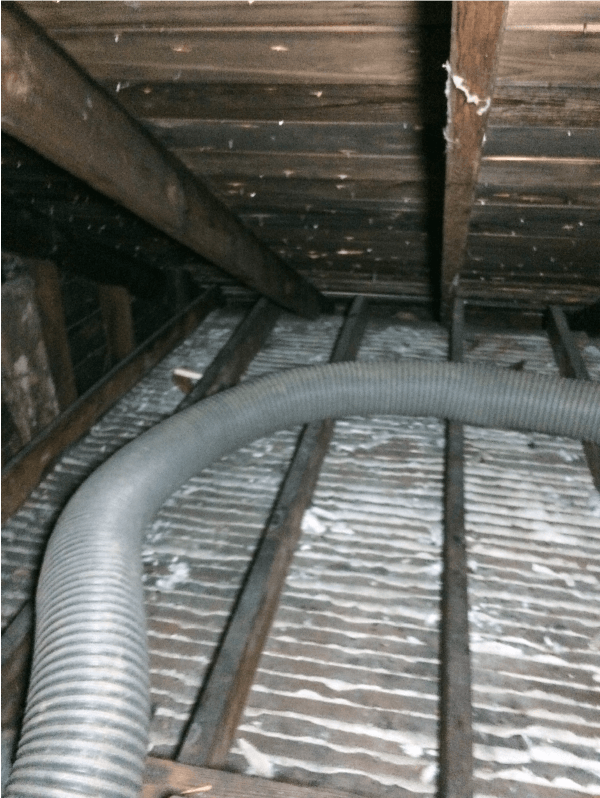

The raccoon population in urban areas has exploded in the past ten years. Raccoons living in sewers have adapted to move their homes from trees to learn to enter attics and fireplaces. Removing a raccoon should only be attempted by a trained professional. It is dangerous to set a trap with a live raccoon in an attic. The raccoon could be caring for raccoon cubs and be very protective of their young. It could be a situation where the homeowner doesn’t know that the cubs have grown to full size and could be attacked by four or five raccoons at once. As you can see, an attic is dangerous because it has no floor. If there is a trap in the back of an attic with a raccoon mother, you have no floor to escape quickly. Therefore, people who fall through the attic (the roof) can cause serious injury, not to mention that the mother raccoon follows you.

Squirrels chewing through the siding to enter an attic or between floors have always been a common nuisance for homeowners. Once in the attic, squirrels can traverse the wires creating a serious fire hazard and costly electrical contractor bills for wiring. The best method of getting rid of squirrels is to set traps in one direction at the point of entry to the structure. In this way, the squirrel leaves on its own but cannot re-enter. If the squirrel is persistent, the next option is to catch and remove the squirrel to a legal wildlife refuge.

Armadillos, skunks and opossums usually have urban residence. Cities will only come and collect them if you already have them trapped. Rats and bats must be quickly removed from structures before they overload the property.

Wildlife elimination has become an industry separate from pest control. A wildlife removal company will use natural Chipmunk Removal methods and traps to get rid of pesky animals. Pest control uses chemicals to control insects.